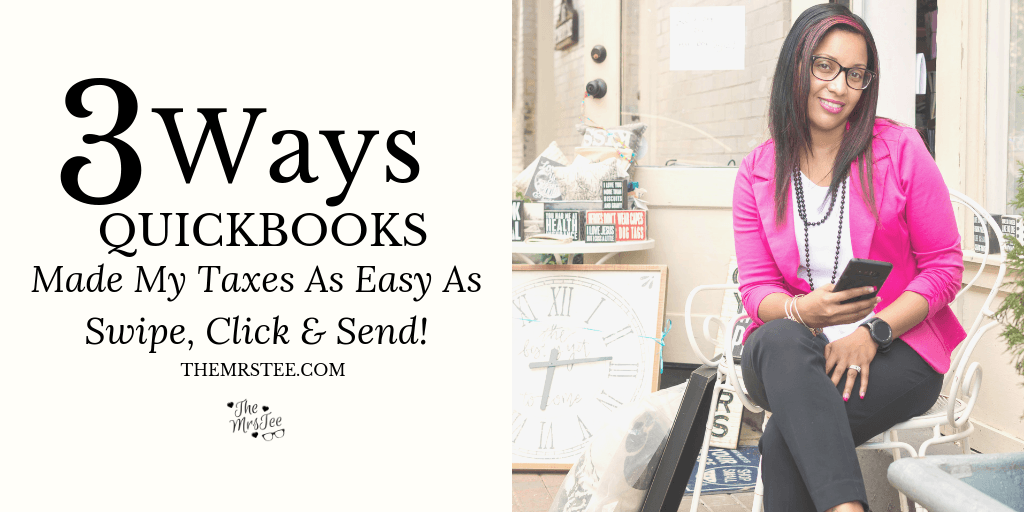

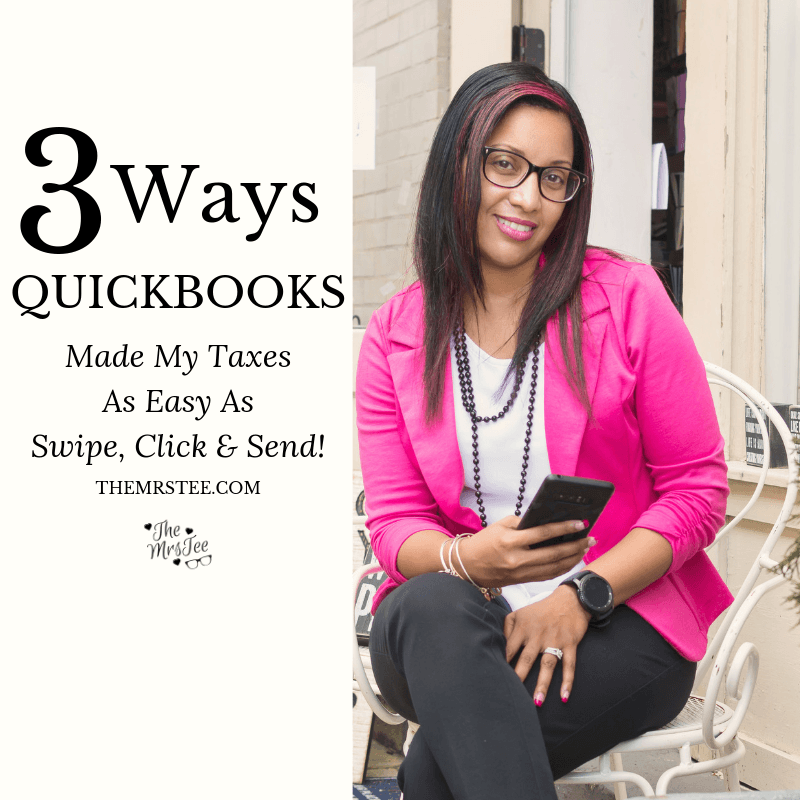

One of my biggest fears, when I started my small business: my taxes! I was terrified, confused and anxious. I had no clue what to save, claim or ignore. Until now. The Quickbooks™ Self-Employed App made my taxes as easy as swipe, click – send!

Taxes Scared Me

Okay so let’s have a quick confession time. My first year as an official self-employed entrepreneur with an EIN and LLC was a bit scary. I had no idea what to keep track of or how to submit it. I have an awesome accountant who took the time (nearly 2 hours) to sit and go through my stacks of emails, invoices, and receipts sifting through what I needed and what was irrelevant. It wasn’t pretty.

As I sat there trying to remember how many miles it was to that last workshop or where the receipt for that business lunch was I realized this was not going to work for long. I was completely frustrated and felt overwhelmed, to say the least.

QuickBooks Self-Employed

That day I walked out of my accountant’s office searching for a solution. If you know me you know I always believe there’s an App for everything and I’m usually right. When I found the Quickbooks™ Self-Employed App it proved my theory once again.

I’d heard of Quickbooks before but felt it had to be for larger more established businesses. I just didn’t think it was something for me. I was so wrong!

The Quickbooks™ Self-Employed App gives me the option to connect my bank accounts, track my mileage and snap a pic of receipts. It has everything I need to keep track of my annual income, expenses and deduction all in one convenient and easy to use App.

Quickbooks™ also offers a Small Business version but since I have no employees the Self-Employed was the best option for me.

Swipe

Wanna know what I love most about the Quickbooks™ Self-Employed App? I don’t need to be an accountant to figure it out. Everything I need to do is as easy as swipe right for Business swipe left for Personal – that’s it!

Once you have created your account and set up the connections to your bank accounts Quickbooks™ does the rest. I go into the App at least twice a week – daily if I know it’s been busy – and check my Dashboard.

First, I check my transactions. Quickbooks™ lists every purchase and charge made to my attached accounts. I go through and swipe left if it was a personal expense and swipe left for Business. I even have the option to add categories and tags to each expense. Ex: Business Lunch, Advertising, Marketing, etc.

Next, I check my mileage. Quickbooks™ automatically logs my mileage according to my specifications. I still have the swipe left for Business right for Personal option and the automatic mileage tracking allows me to see me potential deductions based on my mileage.

Quickbooks™ also offers options for sending invoices and receiving payments.

Click & Send!

So flash forward to this tax season. I walked into my accountant’s office sans boxes of receipts and folders of invoices. Instead, I had my Quickbooks™ Self-Employed App in hand and with just a few clicks to to complete my 2018 Tax Checklist I was able to send my Final Tax Summary directly to my accountant!

He printed it, reviewed it and I was done in less than 30 minutes! Now that’s a big save from my first year and just another reason why I am happy I found Quickbooks™ Self-Employed for my small business.

Try It For Yourself

Now you know I never share without giving you a way to try things out for yourself. Click HERE to check out for Quickbooks™ Self-Employed at 50% OFF!

- The ‘Dirt’ on Dirty Whiskey Craft Cocktail Bar – August 6, 2021

- I Never Went To Prom – Will A Fashion Show Do? – May 1, 2021

- Cape Fear Regional Theatre – Best In The House – May 1, 2021

Leave a Reply